For many investors, few moments feel more rewarding than watching a portfolio flash green. Seeing an asset rise above its purchase price can trigger a rush of excitement and confidence, as if the gain is already secured. Yet these “profits” are often only on paper — unrealized and vulnerable to sudden shifts in the market.

This emotional pull is not just anecdotal; it is a well-documented phenomenon in behavioral finance. The psychology of unrealized profits can influence decisions in ways that either enhance or undermine long-term success. Understanding these biases is crucial for investors who want to move from chasing impulses to following discipline.

Why Paper Gains Feel So Real

Unrealized profits, by definition, exist only as long as an asset is held. No sale has occurred, no return is locked in, and yet the sense of reward can be overwhelming. This happens because of how the human brain processes “gains”:

- Loss Aversion: Behavioral studies show that people fear losses about twice as much as they value equivalent gains. When investors see a gain, they rush to protect it — even if selling too early means missing bigger upside.

- FOMO (Fear of Missing Out): Surging markets amplify anxiety. Watching peers celebrate realized profits can pressure investors into hasty exits, driven more by social comparison than by strategy.

- Regret Aversion: Investors often sell early to avoid the pain of seeing gains disappear. Ironically, this can lead to regret when prices continue climbing after they’ve sold.

In short, paper gains activate powerful emotional triggers that can cloud rational decision-making.

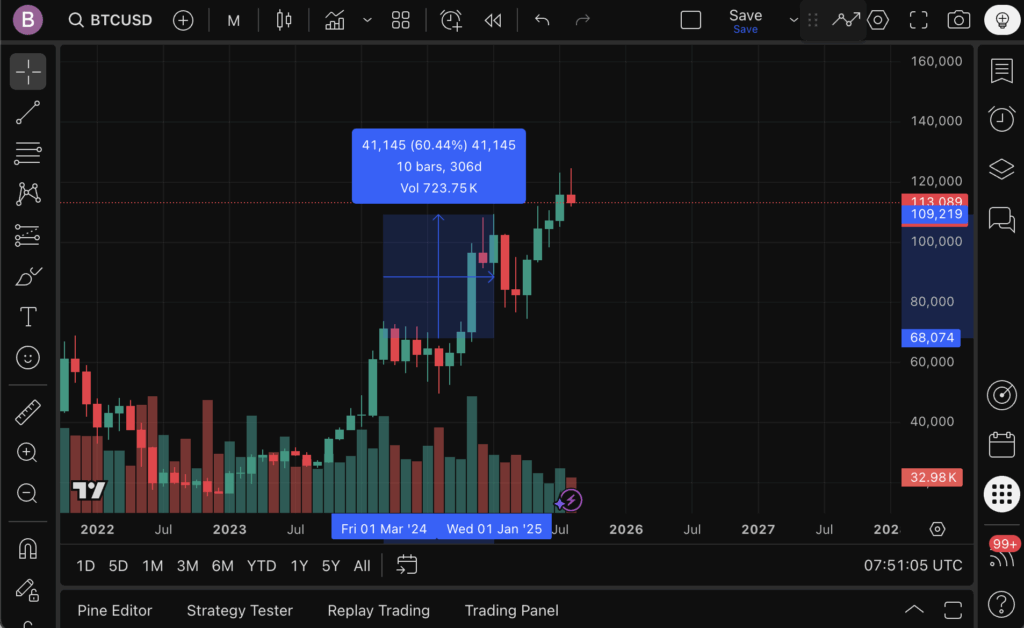

A Real-World Example: Bitcoin in 2024–2025

Consider Bitcoin’s surge from March 2024 to January 2025. In March, the price spiked to $68,000, tempting many to sell. Those who exited early “locked in” their profits — but also capped their returns. Investors who held their positions until January 2025, however, were able to sell closer to $109,000, roughly 60% higher than the March peak.

The difference wasn’t luck. It was discipline. Those who resisted the urge to cash out at the first sign of green numbers realized significantly stronger outcomes.

How Unrealized Profits Can Mislead Investors

The danger is not in celebrating unrealized gains — it’s in mistaking them for outcomes. Three common traps include:

- Premature Selling: Locking in gains too soon cuts off the potential for higher returns.

- Overconfidence: Seeing consistent unrealized gains can cause investors to underestimate risks.

- Emotional Whiplash: When markets swing, unrealized profits can turn into losses just as quickly, fueling stress and reactive decision-making.

Unrealized profits are signals of positioning, not secured results. Interpreting them correctly is what separates disciplined investors from reactive ones.

Bitward’s View: Filtering Emotion with Strategy

At Bitward, we recognize how powerful these psychological forces can be. That’s why our investment framework is designed to counteract them. We rely on three pillars — long-term focus, strategic realization, and risk management discipline — to ensure that decisions are not driven by fear or excitement.

By combining behavioral awareness with data-driven strategy, we help investors see unrealized profits for what they truly are: opportunities, not guarantees.

Conclusion

The psychology of unrealized profits reminds us that investing is as much about mindset as it is about markets. While paper gains can feel like victories, they only become meaningful once realized at the right time. The discipline lies in resisting emotional impulses and letting strategy guide the outcome.

At Bitward, our role is to provide that discipline — turning signals into secured results.

Key takeaway: Unrealized profits reflect opportunity; realized profits secure the outcome.

Discover how disciplined strategies can transform opportunity into realized success — start with Bitward. 👉 Contact our Investor Relations Team.