Navigating the complexities of cryptocurrency with precision, trust and expertise.

A Portfolio Built for GrowthStabilityInnovationThe FuturePerformanceSuccessResilienceLong-Term ValueOpportunityMarket Cycles

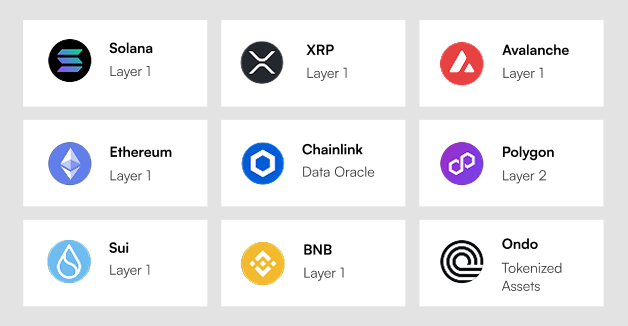

Our portfolio is designed for diversification and risk-adjusted returns, balancing established digital assets with emerging opportunities. See how we allocate across key investments to navigate market cycles effectively.

A Portfolio Built for GrowthStabilityInnovationThe FuturePerformanceSuccessResilienceLong-Term ValueOpportunityMarket Cycles

Our portfolio is designed for diversification and risk-adjusted returns, balancing established digital assets with emerging opportunities. See how we allocate across key investments to navigate market cycles effectively.

Private Investor

Bitward’s disciplined approach to risk was what truly caught my attention. This isn’t about chasing quick gains—it’s about long-term positioning, strategic allocation, and managing capital through market cycles. That level of discipline and clarity is exactly what I was looking for in a digital asset partner.

Private Investor

What impressed me most was the clarity — in a space often clouded by hype, Bitward stands out with structure, transparency, and thoughtful risk management. As someone transitioning from traditional finance, it gave me a secure, compliant entry point into crypto—without compromising on professionalism or performance.

Private Investor

Bitward’s disciplined approach to risk was what truly caught my attention. This isn’t about chasing quick gains—it’s about long-term positioning, strategic allocation, and managing capital through market cycles. That level of discipline and clarity is exactly what I was looking for in a digital asset partner.

Private Investor

What impressed me most was the clarity — in a space often clouded by hype, Bitward stands out with structure, transparency, and thoughtful risk management. As someone transitioning from traditional finance, it gave me a secure, compliant entry point into crypto—without compromising on professionalism or performance.

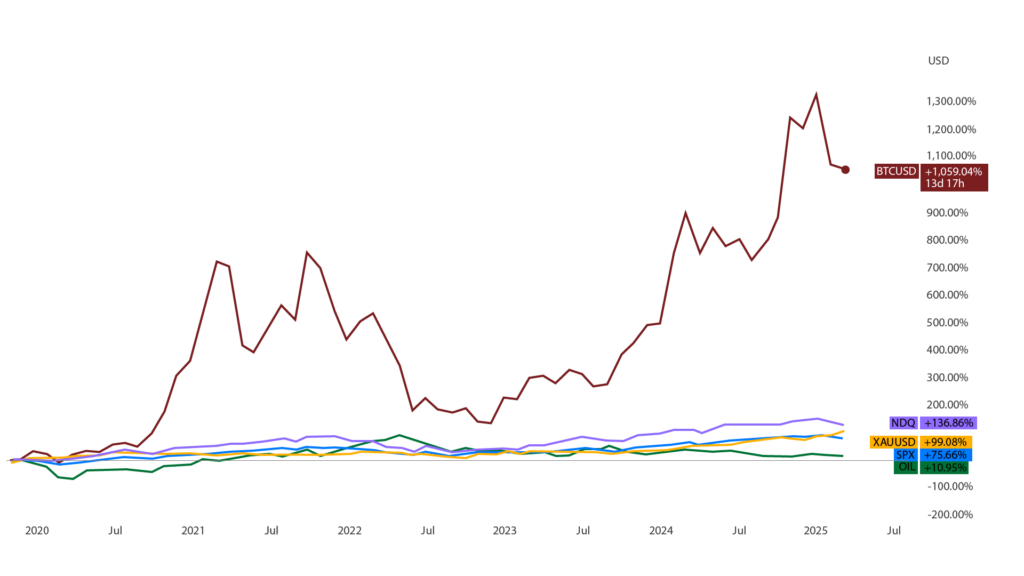

Bitcoin and digital assets have outperformed all major asset classes over the past decade. With experts forecasting Bitcoin to reach $127K by 2025 and institutional adoption accelerating, the opportunity is now. As inflation rises, currencies weaken, and global debt climbs, digital assets are becoming the go-to hedge against economic uncertainty. Meanwhile, tokenization is unlocking trillions in market potential, making crypto the most exciting financial revolution of our time. At BITWARD, we provide the security, expertise, and access you need to navigate this dynamic landscape.

BVI-regulated, insured custody, KYC/AML compliant.

Indicates performance reports and real-time insights.

Balanced exposure across

asset classes.

Represents experienced investment managers and trust.

Adapting to crypto market cycles.

Suggests VIP access to high-yield DeFi and early-stage investments.

Indicates performance reports and real-time insights.

Represents experienced investment managers and trust.

Suggests VIP access to high-yield DeFi and early-stage investments.

Indicates performance reports and real-time insights.

Represents experienced investment managers and trust.

Suggests VIP access to high-yield DeFi and early-stage investments.

Ensuring trust through robust compliance and risk management. Our framework aligns with BVI regulations and global standards to protect investors and uphold transparency.

Strict anti-money laundering measures to detect and report suspicious activity, ensuring full regulatory compliance.

Mandatory tax reporting via CRS documents, ensuring global compliance and transparency.

Secure investor onboarding with Synaps.io, verifying identities through government-issued IDs and risk screening.

Regular audits and continuous risk assessments to track investor activity and mitigate compliance risks.

Enhanced verification for U.S. investors using VerifyInvestor to comply with SEC regulations.

Multi-signature wallets and cold storage protect digital assets with periodic security audits

Strict anti-money laundering measures to detect and report suspicious activity, ensuring full regulatory compliance.

Secure investor onboarding with Synaps.io, verifying identities through government-issued IDs and risk screening.

Enhanced verification for U.S. investors using VerifyInvestor to comply with SEC regulations.

Mandatory tax reporting via CRS documents, ensuring global compliance and transparency.

Regular audits and continuous risk assessments to track investor activity and mitigate compliance risks.

Multi-signature wallets and cold storage protect digital assets with periodic security audits

Have questions or ready to take the next step?

Let’s explore how Bitward can help you navigate digital assets with clarity, discipline, and long-term perspective.

Navigate the complexities of cryptocurrency investments with precision and care.